Looking for a free kids debit card that teaches financial responsibility through chores? You're in the right place. Many parents are using digital solutions to manage allowances and chores, and several providers now offer genuinely free options. Based on the latest research, Starling Kite is the top free pick for UK families, while Modak and Till Financial take the lead for US families seeking cards with zero monthly fees.

This guide compares eight top kids debit cards that support chore-based allowances, highlighting which ones are truly free and which offer the best value for kids' money skills.

The way kids earn pocket money is changing fast. New data reveals even fewer UK families pay traditional pocket money, favoring chores and side hustles. The average child received £479.96 last year (£9.23 weekly).

As earning-based allowances rise, demand grows for debit cards with chore tracking built in. Many options charge £3.99–£5.99 per month, adding up to over £70 per year per child. But you can now get similar features for free. This guide explores 8 leading cards—4 in the UK and 4 in the US—to help you find the best free kids debit card for chores in 2026.

Starling Kite: Best Free Kids Debit Card for UK Families

Best for: UK families who bank with Starling and want a completely free debit card

Starling Kite stands alone as the only genuinely free UK kids debit card with no monthly fee, no card delivery charge, and no sneaky extras. Starling moved Kite from £2/month to totally free in late 2023, making it the most cost-effective choice for 2026.

Key Features

- Instant transfers and real-time spend notifications

- Strong parental controls

- KiteLink for gifts from friends and family directly to the card

- Fee-free international spending

- No minimum age for parent account

Pros

- Completely free to use for families with a Starling account

- FSCS-protected funds up to £85,000

- Fee-free usage abroad

Cons

- No in-app chore tracking system

- Parent must have a Starling account

- Ages capped at 15

Who Should Use Starling Kite

- Budget-conscious UK families already with Starling

- International travelers

- Those who value banking security over add-ons

HyperJar Kids: Best Free UK Alternative without Banking Requirements

Best for: UK families seeking zero monthly fees without changing bank

HyperJar Kids offers free kids cards to all UK residents—with only a £4.99 one-off fee for the card.

Key Features

- Jar-based budgeting—create, personalize, and manage money pots

- Instant notifications and spend limits

- No foreign transaction fees

- No monthly charges (just a one-time fee)

Pros

- Anyone can sign up—no bank tie-in

- Visual, child-friendly system

- Fee-free spending overseas

Cons

- No chore tracking built-in

- Usage limits: 10 free loads per month

- Not a bank (FCA e-money protection, not FSCS)

NatWest Rooster Money: Best for Chore Tracking and Allowances

Best for: Customers of NatWest, RBS, and Ulster Bank who want in-depth chore and allowance management

Rooster Money is the UK's gold standard for chore management. It's free for NatWest/RBS/Ulster Bank customers, or £1.99/month for others.

Key Features

- Full chore/allowance system (track, schedule, approve)

- Multi-parent and multi-child support

- Flexible "stars" reward system

- Family and friends can send money directly

US Market: Modak, Till Financial, GoHenry, Greenlight

Below is a summary comparison for the leading US options, shown side-by-side:

Modak: Premier Free Chore and Allowance Card (US)

Best for: American families who want a completely free, full-featured solution

Modak offers robust chore tracking, allowance automation, and gamified rewards—all at zero subscription cost.

Key Features

- Flexible recurring chores and approval

- Rewards system (daily step goals, etc.)

- Instant parental controls and notifications

Pros

- Genuinely free (ACH/bank loads free; debit loads /bin/zsh.50)

- All core features rival paid services

- Strong user reviews (4.7+ app store rating)

Cons

- No ATM access

- Fees for debit/credit loads

How to Pick the Best Free Kids Debit Card for Chores

Consider your location

- UK: Starling Kite, HyperJar Kids, and Rooster Money (for NatWest/RBS customers) are best free options

- US: Modak and Till Financial are fully free

- Worldwide: Greenlight and GoHenry (premium, but feature-heavy)

Consider your banking

Chore system needed?

- Robust chores: Rooster Money, GoHenry, Greenlight, Modak

- Basic automation: Starling Kite, HyperJar

Education or investing priorities?

- Premium education: GoHenry, Greenlight

- Investing: Greenlight

Conclusion

Teaching your child about money with chores and a debit card is easier than ever in 2026. There are now multiple genuinely free options for UK and US families.

- Starling Kite (UK) and Modak/Till Financial (US) provide all the essentials without monthly fees

- For advanced features and premium education, GoHenry and Greenlight are worth the investment for many families

Pick the one that fits your family best—and start teaching smart money habits today!

Looking for a free kids debit card that teaches financial responsibility through chores? You're in the right place. Many parents are using digital solutions to manage allowances and chores, and several providers now offer genuinely free options. Based on the latest research, Starling Kite is the top free pick for UK families, while Modak and Till Financial take the lead for US families seeking cards with zero monthly fees.

This guide compares eight top kids debit cards that support chore-based allowances, highlighting which ones are truly free and which offer the best value for kids' money skills.

The way kids earn pocket money is changing fast. New data reveals even fewer UK families pay traditional pocket money, favoring chores and side hustles. The average child received £479.96 last year (£9.23 weekly).

As earning-based allowances rise, demand grows for debit cards with chore tracking built in. Many options charge £3.99–£5.99 per month, adding up to over £70 per year per child. But you can now get similar features for free. This guide explores 8 leading cards—4 in the UK and 4 in the US—to help you find the best free kids debit card for chores in 2026.

| Card Name | Monthly Fee | Age Range | Chore Tracking | Automated Allowance | Card Cost | Best For | Country |

|---|---|---|---|---|---|---|---|

| Starling Kite | Free | 6-15 | No | Yes (scheduled transfers) | Free | UK families with Starling accounts wanting free card | UK |

| HyperJar Kids | Free | 6-17 | No | No | £4.99 one-time | Budget-conscious families wanting no monthly fees | UK |

| NatWest Rooster Money | £1.99/month or £19.99/year (Free for NatWest customers) | 6-17 | Yes | Yes | Free (customization £4.99) | NatWest/RBS customers wanting chore management | UK |

| Revolut <18 | Free (with Standard parent account) | 6-17 | Yes (Revolut Earn) | Yes | Free (customization fee may apply) | Families already using Revolut | UK/EU |

| Modak | Free | Under 18 | Yes | Yes | Free | US families wanting completely free option | USA |

| Till Financial | Free | Any age | Yes | Yes | Free | US families focused on savings goals | USA |

| GoHenry | £3.99/month | 6-18 | Yes | Yes | Free (customization £4.99) | Families wanting comprehensive financial education | UK |

| Greenlight | $5.99/month | Any age | Yes | Yes | Free | US families wanting investment features | USA |

Starling Kite: Best Free Kids Debit Card for UK Families

Best for: UK families who bank with Starling and want a completely free debit card

Starling Kite stands alone as the only genuinely free UK kids debit card with no monthly fee, no card delivery charge, and no sneaky extras. Starling moved Kite from £2/month to totally free in late 2023, making it the most cost-effective choice for 2026.

Key Features

- Instant transfers and real-time spend notifications

- Strong parental controls

- KiteLink for gifts from friends and family directly to the card

- Fee-free international spending

- No minimum age for parent account

Allowance Tracker for Kids

Help kids save and track their allowance goals

Savings Goal

Save for new toy

| Feature | Details |

|---|---|

| Monthly Fee | Free |

| Card Delivery | Free |

| ATM Withdrawals | Free |

| Foreign Spend | Free |

| Age Range | 6–15 |

Pros

- Completely free to use for families with a Starling account

- FSCS-protected funds up to £85,000

- Fee-free usage abroad

Cons

- No in-app chore tracking system

- Parent must have a Starling account

- Ages capped at 15

Who Should Use Starling Kite

- Budget-conscious UK families already with Starling

- International travelers

- Those who value banking security over add-ons

HyperJar Kids: Best Free UK Alternative without Banking Requirements

Best for: UK families seeking zero monthly fees without changing bank

HyperJar Kids offers free kids cards to all UK residents—with only a £4.99 one-off fee for the card.

Key Features

- Jar-based budgeting—create, personalize, and manage money pots

- Instant notifications and spend limits

- No foreign transaction fees

- No monthly charges (just a one-time fee)

| Feature | Details |

|---|---|

| Monthly Fee | Free |

| Card Fee | £4.99 one-time |

| Foreign Spend | Free |

| Inactivity Fee | £3 (after 12 months inactivity) |

| Age Range | 6–17 |

Pros

- Anyone can sign up—no bank tie-in

- Visual, child-friendly system

- Fee-free spending overseas

Cons

- No chore tracking built-in

- Usage limits: 10 free loads per month

- Not a bank (FCA e-money protection, not FSCS)

NatWest Rooster Money: Best for Chore Tracking and Allowances

Best for: Customers of NatWest, RBS, and Ulster Bank who want in-depth chore and allowance management

Rooster Money is the UK's gold standard for chore management. It's free for NatWest/RBS/Ulster Bank customers, or £1.99/month for others.

Key Features

- Full chore/allowance system (track, schedule, approve)

- Multi-parent and multi-child support

- Flexible "stars" reward system

- Family and friends can send money directly

US Market: Modak, Till Financial, GoHenry, Greenlight

Below is a summary comparison for the leading US options, shown side-by-side:

Chore Chart for Kids

Organize and track daily chores and responsibilities

Today's Chores

1/3 completed

| Card Name | Monthly Fee | Ages | Chore Tracking | Allowance Automation | Card Cost | Country | Best For |

|---|---|---|---|---|---|---|---|

| Modak | Free | < 18 | Yes | Yes | Free | USA | Free, full-featured, rewards |

| Till Financial | Free | Any | Yes | Yes | Free | USA | Savings goals, family collaboration |

| GoHenry | .99/month | 6–18 | Yes | Yes | Free (custom .99) | USA/UK | Comprehensive education, premium features |

| Greenlight | .99/month | Any | Yes | Yes | Free | USA | Investing, advanced controls, up to 5 kids |

Modak: Premier Free Chore and Allowance Card (US)

Best for: American families who want a completely free, full-featured solution

Modak offers robust chore tracking, allowance automation, and gamified rewards—all at zero subscription cost.

Key Features

- Flexible recurring chores and approval

- Rewards system (daily step goals, etc.)

- Instant parental controls and notifications

Pros

- Genuinely free (ACH/bank loads free; debit loads /bin/zsh.50)

- All core features rival paid services

- Strong user reviews (4.7+ app store rating)

Cons

- No ATM access

- Fees for debit/credit loads

How to Pick the Best Free Kids Debit Card for Chores

Consider your location

- UK: Starling Kite, HyperJar Kids, and Rooster Money (for NatWest/RBS customers) are best free options

- US: Modak and Till Financial are fully free

- Worldwide: Greenlight and GoHenry (premium, but feature-heavy)

Consider your banking

| If you bank with... | Best free option |

|---|---|

| Starling (UK) | Starling Kite |

| NatWest/RBS/Ulster (UK) | Rooster Money |

| Any US bank | Modak or Till |

Chore system needed?

- Robust chores: Rooster Money, GoHenry, Greenlight, Modak

- Basic automation: Starling Kite, HyperJar

Education or investing priorities?

- Premium education: GoHenry, Greenlight

- Investing: Greenlight

Conclusion

Teaching your child about money with chores and a debit card is easier than ever in 2026. There are now multiple genuinely free options for UK and US families.

- Starling Kite (UK) and Modak/Till Financial (US) provide all the essentials without monthly fees

- For advanced features and premium education, GoHenry and Greenlight are worth the investment for many families

Pick the one that fits your family best—and start teaching smart money habits today!

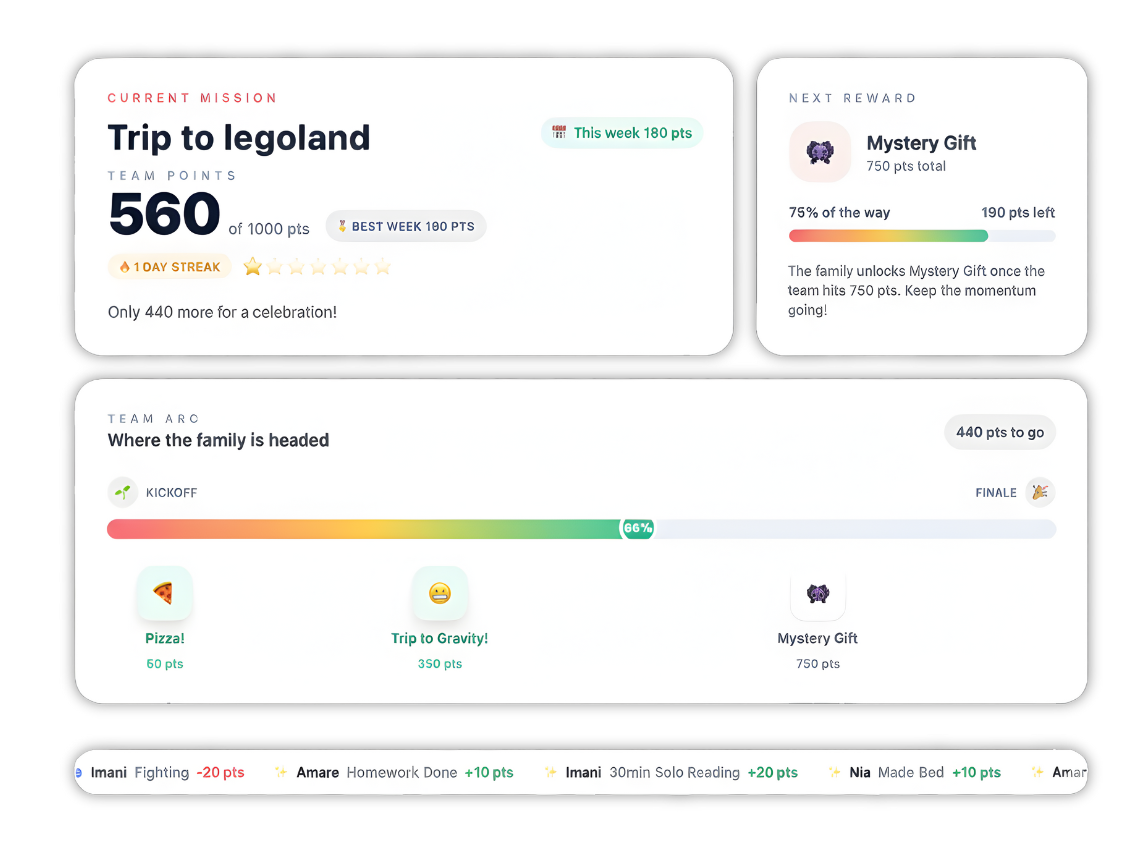

Ready to Start Teaching Smart Money Habits?

Join thousands of families combining chores, allowances, and debit cards to build financial responsibility. Try Family Goals free for 7 days.

Start Your Family Journey